How Attractive Are Rental Yields in Portugal? Is It Worth Investing?

When evaluating overseas property markets, rental yield is often one of the most important indicators.

Rental yield refers to the ratio between a property’s annual rental income and its purchase price. Put simply, it measures how long it would take for rental income to recover the cost of acquiring the property. The higher the yield, the faster the cash flow return and the stronger the property’s income-generating capacity.

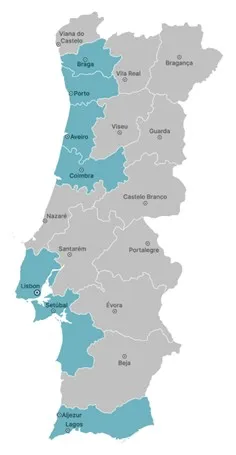

However, before determining whether a city offers strong investment potential, it is essential to understand the rental yield structure across different regions in Portugal.

What Is the Overall Rental Yield Level in Portugal?

Across the Portuguese market, long-term rental yields generally fall within the 5%–7.5% range. Compared to other major European countries, this represents a relatively healthy and attractive level of return.

Variations between cities are mainly driven by differences in property prices, rental demand structure, and population mobility.

Comparative Analysis of Major Cities

From a structural perspective, rental performance across Portugal shows clear segmentation by city tier.

Lisbon, as the country’s capital and economic hub, has the highest property prices and rental levels nationwide. Long-term rental yields typically range between 5% and 5.6%, while legally operated short-term rentals may achieve yields of approximately 6.8%. Lisbon’s strength does not lie in exceptionally high yield percentages, but rather in its stability and liquidity. With high population density, a concentration of international companies, continuous inflow of foreign residents, and sustained rental demand, Lisbon properties generally demonstrate strong resilience and long-term holding value.

In comparison, Porto offers a slightly higher rental yield structure due to its lower entry price point. City-center yields average around 5.8%, while suburban areas can reach between 6.1% and 7.4%. Porto has experienced notable growth in tourism, technology, and creative industries in recent years, increasing economic activity and supporting rental demand. For buyers seeking relatively higher yield ratios with a lower capital threshold, Porto presents an appealing alternative.

Among secondary cities, Braga and Coimbra stand out for their stronger yield performance. In Braga, central areas deliver yields of approximately 6.95%, with suburban areas reaching 7.27%. The city’s young demographic profile and strong residential demand contribute to stable occupancy levels. Coimbra, a traditional university city, offers yields of around 5.5% in the city center and close to 7.9% in surrounding areas. Student housing demand provides long-term structural support for the rental market. These cities typically feature lower property price bases and higher yield ratios, although overall liquidity and international visibility may be lower than in major metropolitan areas.

Overall, core cities emphasize stability and liquidity, while secondary cities tend to offer higher yield percentages. There is no absolute “better” city—each option aligns differently depending on long-term objectives and risk tolerance.

Does a Higher Yield Automatically Mean a Better Investment?

It is important to note that rental yield is only one dimension of evaluation.

Higher yields often come with additional variables, including:

- Vacancy rates

- Rental difficulty

- Tenant stability

- Management efficiency

- Long-term regional development prospects

Focusing solely on a high percentage figure does not necessarily indicate superior long-term asset quality. A sustainable investment strategy balances yield, liquidity, stability, and risk management.

Prime areas in Lisbon and central Porto typically offer stable rental ratios and strong asset liquidity, making them suitable for long-term, steady allocation. Meanwhile, secondary cities such as Braga and Coimbra, along with suburban zones, provide higher yield potential and lower entry thresholds, appealing to cash-flow-oriented strategies.

A Rational Perspective on Rental Yield

Rental yield should be viewed as a reference tool rather than a definitive answer. The ultimate objective of asset management is not simply to pursue the highest numerical return, but to build a portfolio capable of stable long-term operation, controlled risk exposure, and sustainable growth.

Portugal’s diverse regional structure offers multiple pathways depending on strategic priorities. Understanding the structural logic behind the data is far more important than merely comparing percentages.

We will continue to analyze the Portuguese real estate market from a data-driven perspective, helping readers make informed and balanced decisions with greater clarity and confidence.