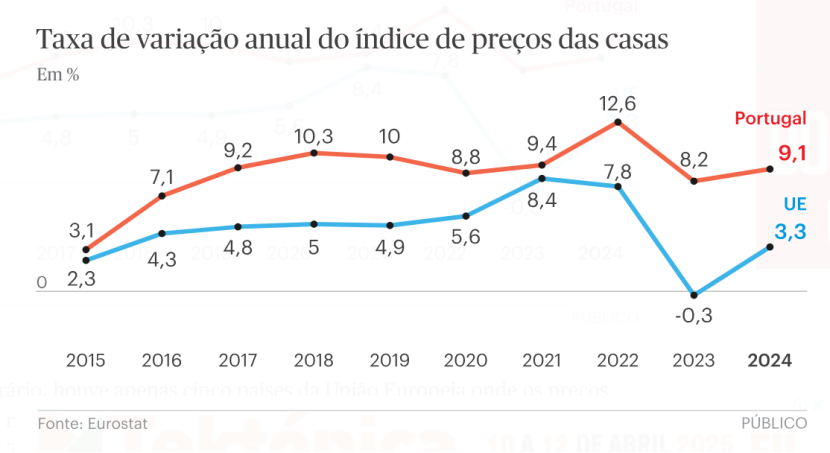

According to data released by Eurostat on Tuesday, Portuguese house prices rose by 9.1% in 2024, nearly three times the EU average of 3.3%, making it the sixth-highest in the EU. While house prices across the EU have been rising over the past decade, there was a brief dip in 2023, but they resumed their upward trend in 2024. The average house price increase in the eurozone was 2%. Portugal's increase far exceeded this level, trailing only Bulgaria, Croatia, Lithuania, Hungary, and Poland.

Meanwhile, only five EU countries saw a decline in house prices in 2024. The country with the largest decline was Luxembourg (-5.2%), while Germany and France also experienced decreases. Germany, the largest economy in Europe, saw a 8.5% drop in 2023, followed by a 1.6% decline in 2024; France fell by 3.7%, Finland and Austria by 3.5% and 0.2%, respectively.

Rents are also surging

In addition to house prices, rents are also continuing to rise. In 2024, Portuguese rents increased by 7%, above the EU average of 3.1% and the eurozone average of 2.9%, making it one of the highest increases, second only to Hungary (which saw an increase of over 12%). Other countries with high rent increases include Latvia, Malta, and Romania. The only country to see a decrease in rents was Estonia, with a 0.9% decline in 2024.

The future may be worse, and these five factors are worth watching

The continuous rise in Portuguese house prices is not coincidental, as several deep-seated factors are at play, creating a systemic structural tension. Experts point out that the following five factors will continue to exert strong upward pressure on the Portuguese housing market:

1. Lower interest rates stimulate demand

As the European Central Bank gradually lowers interest rates, mortgages become more accessible, and potential buyers who were waiting on the sidelines re-enter the market, increasing transaction volumes and pushing up prices. Interest rates are currently stabilizing between 2.5% and 3%, and while no significant further cuts are expected, this is already enough to stimulate market activity.

2. Increasing immigrant population drives housing demand

In recent years, the immigrant population in Portugal has been growing, with over 500,000 immigrants now working in the country. Immigrant families, particularly those from Brazil, have similar housing needs to local families, and this is especially evident in medium-sized cities like Braga, driving rapid price increases in these areas.

3. New housing construction severely lagging

Portugal approves only about 30,000 new homes annually, which is far from meeting the rapidly growing demand. Worse still, many approved projects do not start promptly due to labor shortages, high costs, and complex administrative processes, extending construction timelines and exacerbating the supply-demand imbalance. Although the government has promised to reduce VAT in the construction sector to 6% to stimulate new housing supply, these policies have yet to be implemented, and many projects remain in limbo.

4. Young buyer policies drive up prices

The government offers full loan guarantees and stamp duty exemptions for homebuyers under 35. This increases the purchasing power of some young buyers, for example, those who could previously afford 200,000 euros can now offer 250,000 euros, thus pushing up overall market prices. While some argue that this phenomenon is part of the 'natural market dynamics,' most experts believe that these policies, in the short term, undoubtedly drive up transaction prices.

5. Continued influx of foreign investors

In the context of global inflation, war, and political uncertainty, more international investors are viewing Portuguese real estate as a 'safe haven.' Buying off-plan properties (imóveis em planta) has become a popular investment option, with many of these properties remaining vacant, intensifying the speculative atmosphere. Experts warn that without intervention, capital speculation will further drive up prices, making it even harder for ordinary residents to enter the housing market.

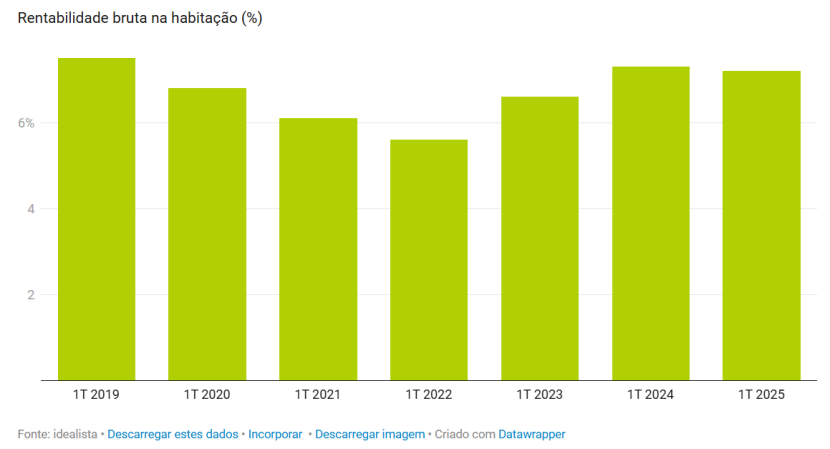

Investment returns remain attractive, with a 7.2% yield

According to data from the real estate platform Idealista, in the first quarter of 2025, the average gross rental yield for residential properties in Portugal reached 7.2%, slightly below the 7.3% in the same period of 2024 but still at a high level in recent years.

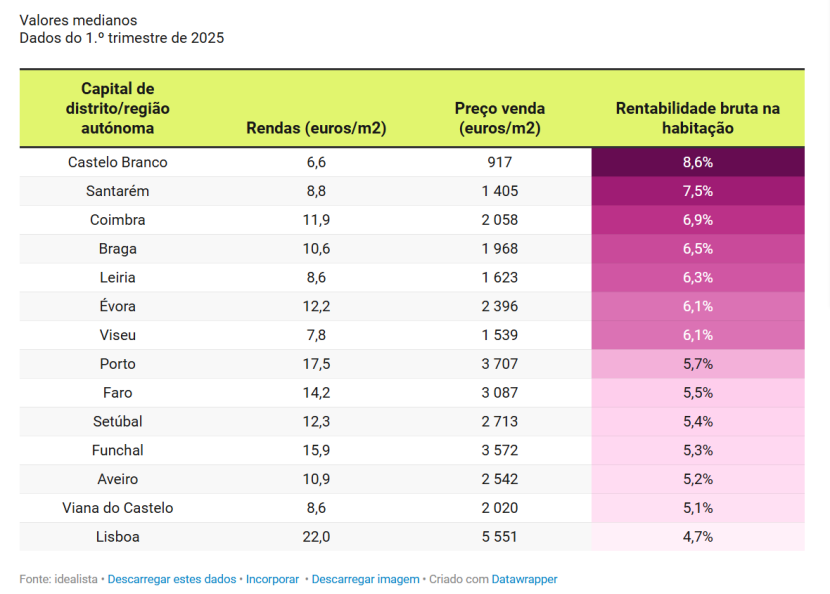

The report notes that house price growth (6.3%) exceeded rental growth (4.9%), but overall investment returns remain attractive. The regions with the highest yields are Castelo Branco (8.6%) and Santarém (7.5%), although these regions are also considered to have higher vacancy and depreciation risks.

In comparison, the lowest yield is in the capital, Lisbon (4.7%), but the investment risk in this area is relatively lower, with lower vacancy rates and a higher likelihood of property appreciation.

Beyond residential properties, the average yields for office spaces, shops, and garages are 8.3%, 8.4%, and 5.7%, respectively, further highlighting the position of the real estate market as a 'safe haven' asset.